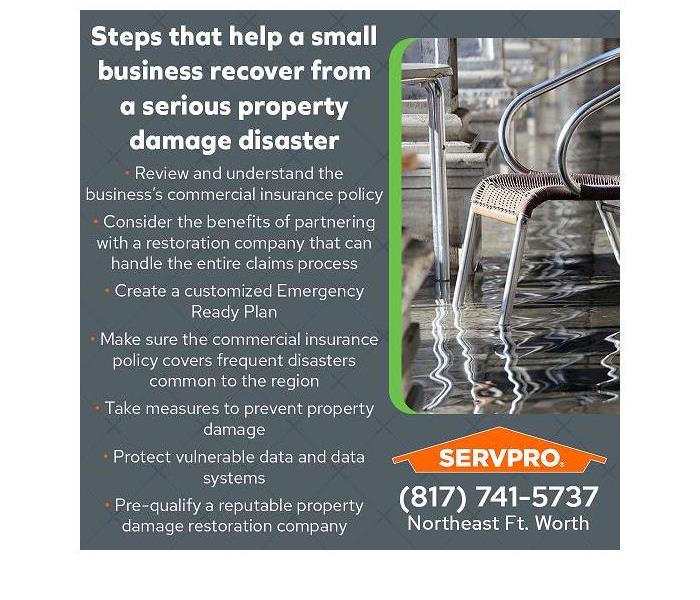

How Local Small Businesses in Watauga, TX, Can Overcome Severe Property Damage

5/12/2022 (Permalink)

Blog Summary: SERVPRO of Northeast Fort Worth shares strategies to help local small businesses quickly recover from devastating property damage.

SERVPRO of Northeast Fort Worth is dedicated to helping small businesses in Watauga, TX, recover from a major property damage disaster by rapidly providing fire, smoke, and water damage restoration services. Loyal customers are the backbone of a small business’s success. They provide consistent repeat business and keep the doors open. A temporary interruption of services or halt in production can result in customers seeking other sources for their needs. A rapid, thorough restoration process gets products and services moving and revenues flowing to satisfy customers’ needs.

How a business responds to a significant property damage disaster can have consequences for future success.

Steps that help a small business recover from a serious property damage disaster.

Step #1: Review and understand the business’s commercial insurance policy.

Major property damage and business interruption insurance policies provide financial protection for a business in the event of a property damage disaster that not only damages the structure but also disrupts the sales and revenue cycle. A thorough understanding of the policy coverage and limits coupled with a working knowledge of how to use the policy during the claims process will ensure the business is protected and comes out on the other side of the disaster ready to move forward at a rapid momentum to make up for lost time and money.

Step #2: Consider the benefits of partnering with a restoration company that can handle the entire claims process.

Policyholders often find the complex, technical language in insurance policies to be confusing and difficult to understand. However, it is not enough for the policyholder to simply make the premium payments according to schedule and assume the carrier will advocate for the policyholder in the event of a claim payout at a fair settlement amount after property damage. The insured party needs to understand to some degree the intricacies of property insurance coverages and the claims process.

When small businesses work with SERVPRO of Northeast Fort Worth, the company’s trained and experienced staff can handle the claims process from beginning to end. The team will work with the insurance company to understand the coverages and the options within the policy to help the business achieve full recovery. The SERVPRO claims professionals most likely have previously worked with the insurance company in the Fort Worth and Dallas area. Claims management will not be an added headache for a business owner striving to restore normal business operations.

Step #3: Create a customized Emergency Ready Plan.

This important process breaks down into many parts. First, conduct a risk assessment of the business operations and the physical plant. Identify any fire hazards or other risks that have gone unnoticed or been neglected. Clarify if the structure is in a flood zone and qualifies for coverage under the National Flood Insurance Program.

Assess any vulnerabilities specific to the landscape’s layout, such as grading and slope issues. Though the facility may not qualify for FEMA flood insurance, subtle changes to the landscape may reduce the likelihood of a micro-flood from a stalled thunderstorm.

Implement safety procedures to address the new risk hazards. Review the safety plan in company meetings. Conduct drills on a scheduled basis, and post signage in high traffic areas. The goal is to cultivate a safety-conscious corporate culture.

Step #4: Make sure the commercial insurance policy covers frequent disasters common to the region.

This step may require a consultation with the insurance agent. Inquire as to what coverage other businesses in the area have. A pattern may indicate an adjustment needs to be made to the policy to reduce exposure in vulnerable areas.

Step #5: Take measures to prevent property damage.

As mentioned above, subtle adjustments to the landscape can protect against flooding. Remove trees or prune branches that can fall onto the roof, causing a puncture and water intrusion. Install a removable flood gate system at vulnerable entryways. Install reinforced doors or strengthen existing doors in areas where flooding can occur. Keep drains free of clutter and debris.

Step #6: Protect vulnerable data and data systems.

Implement a data backup system such as a cloud system. A strategic partnership with IT management professionals is recommended. Outsourced IT management can scale with company growth. Remember to include payroll in the strategy.

Step #7: Pre-qualify a reputable property damage restoration company.

Look for companies with these features:

- Insured, licensed, bonded, and IICRC certifications

- Available 24/7, 365 days a year, including holidays

- Rapid response within an hour or less

- Best equipment, latest technology, advanced cleaning techniques

- Provides detailed and documented estimations

- Can scale to any size or type of disaster

- Manages the insurance claims process

For more information about commercial water damage cleanup and restoration in the 76244 area, call SERVPRO of Northeast Fort Worth, TX, at (817) 900-0580 or email office@SERVPROnortheastftworth.com

24/7 Emergency Service

24/7 Emergency Service